Minimum wage is a critical factor in determining the financial security of many Canadians, especially those working in entry-level or low-paying jobs. It sets the baseline for how much workers are compensated for their labour and plays a significant role in shaping the country’s economic landscape. Across Canada, the minimum wage varies from province to province, reflecting local economic conditions, cost of living, and government policies.

Understanding how much the minimum wage is in your province, what it means for your financial planning, and the ongoing debates around wage increases is essential for anyone navigating the workforce in Canada.

The good news is GoDay does more than just help you get an online loan in Canada when you need quick access to cash. We recognize the value of being informed about minimum wage in Canada, as it can significantly affect your finances and the need to borrow money in some cases. So, let’s explore the key facts about minimum wage, including current rates, the pros and cons of raising it, and how it affects your finances.

What Is the Minimum Wage in Canada?

The minimum wage is the lowest amount of pay that employers are legally required to pay their employees for work. It’s designed to ensure that workers are compensated fairly for their labour. As of 2024, Canada’s federal minimum wage is $17.30 per hour. However, this can vary significantly depending on the province or territory, as each region has the authority to set its own minimum wage rate. This means the rate you receive might differ depending on where you live and work in Canada.

The goal of minimum wage is to provide workers with a standard of living that allows them to meet basic needs. However, debates continue over whether the current minimum wage is sufficient, especially in light of rising living costs. To understand how the minimum wage impacts you, it’s essential to know the minimum wage in your province.

What’s the Minimum Wage in Quebec and Ontario?

Each province and territory in Canada has its own minimum wage rate, and it’s essential to know the specifics depending on where you live. For instance, Québec’s minimum wage is $15.75 per hour as of 2024, slightly below the national rate but still higher than many other areas in Canada.

On the other hand, Ontario’s minimum wage sits at $17.20 per hour, slightly below the federal rate but competitive in comparison to other provinces. It’s important to note that specific sectors, such as those with tipped workers (e.g., waitstaff), may have lower minimum wage rates, with tips supplementing their income. Understanding the minimum wage in your province is crucial for managing your finances and setting realistic budgeting goals.

How Much Is the Minimum Wage in Canada by Province?

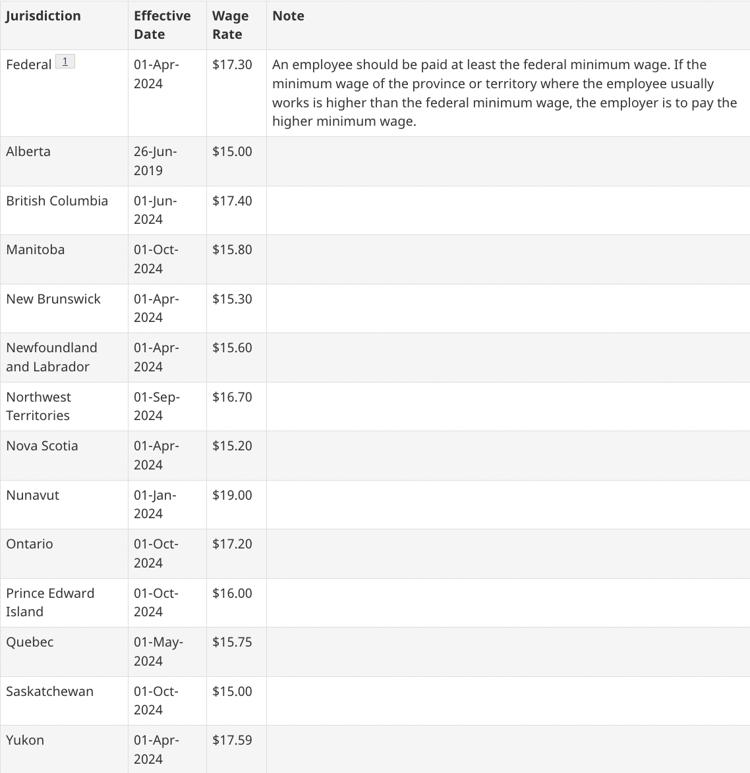

As mentioned earlier, the minimum wage varies by province. Here’s a snapshot of the current minimum wages across Canada in 2024 according to data retrieved from the Government of Canada’s website:

Source: Government of Canada

The variations across these provinces can significantly affect your financial planning, mainly if you live in an area with a high cost of living. It’s essential to consider these differences when budgeting or making career decisions.

The Pros and Cons of Raising Minimum Wage

Raising the minimum wage has long been a point of contention. There are pros and cons when debating the merits of higher wages. One of the most significant advantages is that it helps to lift workers out of poverty. A higher minimum wage can improve the standard of living for millions of Canadians, enabling them to afford necessities like housing, food, and healthcare.

Furthermore, it can stimulate the economy by increasing consumer spending as workers have more disposable income. The province may also experience a boost in income tax revenue as low-wage workers earn a higher minimum wage.

However, there are also some drawbacks. Critics argue that raising the minimum wage could lead to job losses, as employers might be unable to afford to hire as many workers at a higher rate.

Additionally, businesses might raise prices to compensate for the increased labour costs, potentially leading to inflation. It’s also important to consider that higher wages may not automatically correlate with lower poverty rates, as living costs in certain cities (like Vancouver or Toronto) can outpace wage increases.

In cases where minimum wage workers face financial strain, you may want to consider alternatives and apply for a loan online to manage short-term needs, though it’s crucial to borrow responsibly.

How Minimum Wage Affects Your Financial Management

Understanding the minimum wage is critical for managing your money effectively, especially in an inflationary market. If you earn minimum wage, budgeting becomes even more important as you strive to make ends meet. With rising housing, food, and utilities costs, it can be a challenge to cover all your expenses.

To better manage your finances, start by setting clear financial goals. For example, prioritize your essential needs, such as rent, food, transportation, and unexpected medical expenses. From there, use tools like budgeting apps to track your income and spending habits. These apps can help you organize your budget and monitor where your money is going. Whether you need to save for an emergency or pay off high-interest debts, budgeting apps are a great way to stay on track.

If you struggle financially due to low wages, there are also ways to use personal loans responsibly to help bridge the gap. With GoDay, you can apply for a loan online to address short-term needs like paying off your credit card, managing unexpected costs, or covering an emergency expense.

Managing Your Money on Minimum Wage

Managing your money on minimum wage can be challenging, but it’s possible with the right strategies. Start by setting financial goals to focus on what you want to achieve. Whether paying down debt or saving for a rainy day, clear goals help you prioritize your spending.

Once you have goals in mind, create a strict budget. Make sure to track all of your expenses and cut back where possible. Sometimes, this might mean making tough choices, such as reducing discretionary spending on dining out or entertainment.

If you’re living paycheck to paycheck, learning how online loans work when you need some financial breathing room can be beneficial. GoDay’s quick and easy online loans can provide fast access to cash, helping you avoid late fees or missed payments. Just be sure to borrow responsibly and only when necessary.

What Should Minimum Wage Be in Canada?

One of the ongoing debates surrounding minimum wage in Canada is determining what the minimum wage should be to meet the basic needs of workers. Some advocates argue that the current minimum wage doesn’t adequately cover the cost of living, particularly in expensive cities. The growing gap between wages and living costs has led many to call for an increase in the minimum wage to ensure that workers can achieve a better quality of life.

Others argue that increasing the minimum wage could have negative economic consequences, such as job losses and unemployment or higher inflation. The reality is that there is no easy answer to this question. The minimum wage should balance providing workers with a livable income and not placing undue strain on businesses.

Using Personal Loans to Manage Minimum Wage Income

If you’re struggling to make ends meet, a personal loan can be an effective tool to help manage your finances. Personal loans can be used for various purposes, such as covering unexpected medical expenses, sudden home repairs, or paying off your credit card. The key is to use personal loans wisely. Only borrow what you need and ensure you can repay it within the agreed-upon terms.

With GoDay, you can access fast and flexible online loans designed to help you stay financially stable. Remember that taking out a loan should be a last resort. Always explore other options, such as cutting back on non-essential expenses or using budgeting apps to better manage your money before opting for a loan. However, when necessary, personal loans can be a helpful way to cover short-term expenses or help you pay off your credit card while you work on long-term financial stability.

Navigating Minimum Wage and Financial Stability in Canada

In conclusion, the minimum wage in Canada plays a significant role in workers’ lives nationwide. Understanding how much you can earn based on location is critical for planning and managing your finances. Whether you’re asking what the minimum wage is in Ontario, Canada, or how much it is in Canada overall, it’s essential to be informed. This information can also help you set financial goals to ensure your financial health is in good standing.

If you’re finding it challenging to make ends meet, consider using tools like budgeting apps and seeking out financial resources like GoDay to bridge gaps. You can navigate the challenges of earning minimum wage in Canada by managing your finances effectively, setting clear goals, and using loans responsibly.

Remember, whether you’re saving for a rainy day or managing unexpected costs, learning how online loans work can offer a valuable financial resource in times of need. For immediate cash requirements, choose GoDay to apply for a loan online easily.