Navigating the Canadian Pension Plan (CPP) can be a key part of retirement planning for Canadians, and understanding the ins and outs of CPP payments is essential for financial stability. With a solid grasp of CPP, you can make well-informed decisions that support both immediate financial needs and long-term goals.

While we provide online loans in Canada for emergencies, we realize that CPP payments can sometimes be inefficient if you face a sudden emergency expense, such as a medical or home repair bill. Sometimes, you may also need extra cash to cover unexpected costs while waiting for your CPP payment to arrive. Knowing all about CPP payments and alternatives when you need access to cash is helpful.

In this guide, we’ll cover everything you need to know about CPP payments, from eligibility requirements and payment amounts to important CPP payment dates and ways to supplement your income for emergencies.

What Is the Canada Pension Plan (CPP)?

The Canada Pension Plan (CPP) is a public retirement pension system for working Canadians. Established in 1966, the CPP is designed to provide a reliable income source during retirement, primarily funded by contributions from employees and employers. The program offers not only monthly retirement pensions but also disability benefits, survivor benefits, and children’s benefits.

The goal of CPP Canada is to support Canadians in maintaining a stable quality of life after they stop working. Payments begin when contributors reach retirement age, typically 65, although they can start as early as 60 or as late as 70 with adjusted benefit amounts. In addition to the CPP, many Canadians also receive the Old Age Security pension, a supplementary monthly payment.

Eligibility for CPP Payments

Individuals must have contributed to the CPP during their working years to qualify for CPP payments. Contributions are made through payroll deductions and self-employment income taxes. The amount contributed is directly related to earnings, meaning that the more you earn and contribute, the higher your CPP benefits in retirement.

If you’re nearing retirement age and wondering “how much is CPP” for you, your estimated benefits can be checked through your My Service Canada account, which shows your total contributions and monthly CPP payment amount.

How Much Are CPP Payments?

The amount you receive in CPP payments depends on factors such as your contribution history, average income, and the age at which you start collecting benefits. For 2025, the maximum CPP payout for new recipients at age 65 is $1,364.60 per month. However, very few people receive the maximum CPP because it requires consistent contributions at or near the maximum threshold over a long career.

Starting CPP payments early, at age 60, will reduce your monthly amount while deferring payments until age 70 will increase it. Calculating the optimal start time for your payments can help maximize CPP benefits based on your retirement timeline and financial needs.

When Are CPP Payment Dates?

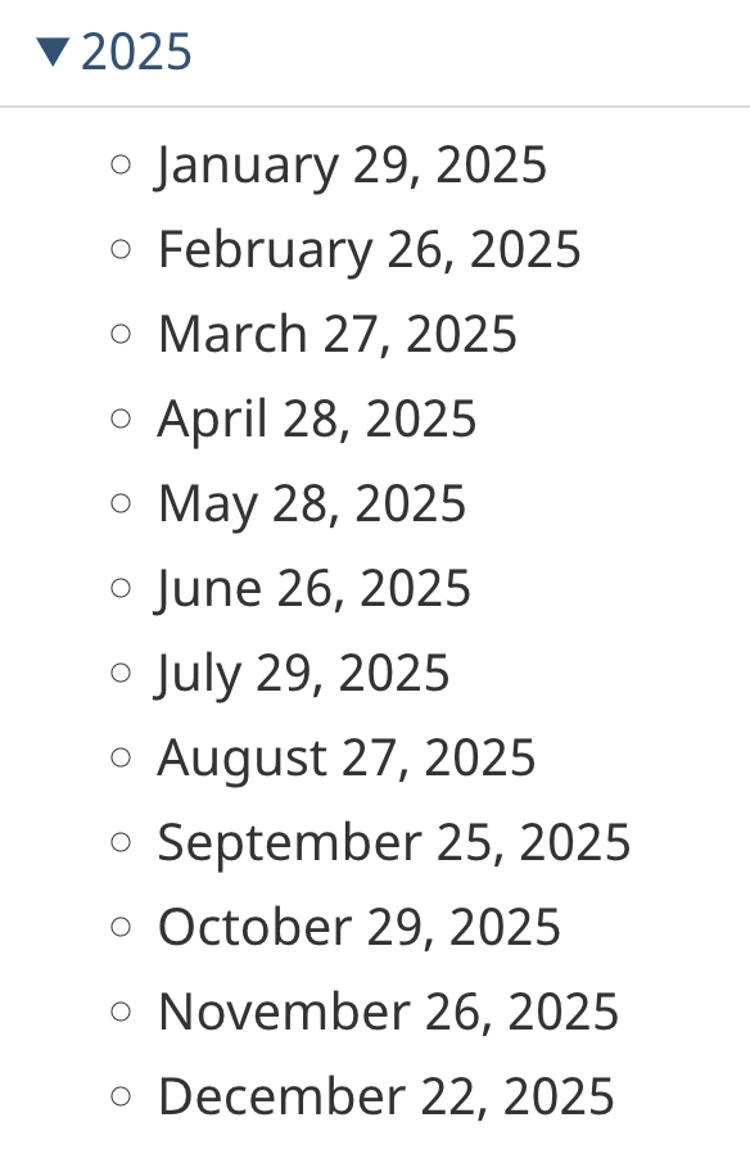

Knowing the CPP payment dates is crucial for managing your retirement income and planning monthly expenses. Typically, CPP payments are deposited directly into your bank account on the third-to-last business day of each month. For instance, if you’re looking for the next CPP payment in November 2024, it falls on November 27. Here is a screenshot of the CPP benefits payment dates as listed on the Government of Canada website:

Being aware of these dates can help with budgeting and setting financial priorities. If you’re supplementing your CPP income with other benefits or savings, aligning those sources with CPP payment dates can create a smooth flow of income to cover monthly expenses.

Are CPP Payments Taxable?

Yes, CPP payments are considered taxable income. This means they must be reported on your annual tax return. Many retirees choose to have income tax withheld from their CPP payments to avoid a significant tax bill at the end of the year.

Understanding the tax implications of CPP and Old Age Security can help with effective money management, especially when balancing other sources of income.

Supplementing Your CPP Income

While CPP Canada is a vital income source for retirees, it may not cover all financial needs. For those who require additional funds, there are various options to consider. CPP loans are available for individuals receiving CPP benefits, providing a supplementary income to manage unexpected expenses or meet financial goals.

CPP loans in Canada can be an option if you need quick access to funds for medical costs, home repairs, or other urgent expenses. When exploring options like installment loans for CPP, it’s essential to understand the loan terms, interest rates, and how these will fit into your monthly budget. Certain providers specialize in loans for retirees, offering flexible terms to accommodate the unique needs of CPP recipients.

Planning for Maximum CPP Benefits

To make the most of CPP, planning your contributions carefully over your working life is beneficial. Contributing at the maximum allowable rate increases your potential payout and helps ensure a more secure retirement. For individuals who can contribute consistently, achieving the maximum CPP can offer a solid foundation for retirement income.

However, if you’re considering retiring early or reducing work hours, remember that decreasing contributions will lower your eventual CPP payments. A strategic approach to contributing can make a significant difference in the long term.

Managing Finances with CPP and OAS

In Canada, many retirees receive CPP and OAS, the backbone of government-provided retirement income. CPP-OAS benefits can provide a stable income stream. However, they may still require supplemental funds to cover living expenses, especially if one hopes to maintain a comfortable standard of living.

If you’re seeking additional income, options like a CPP loan or an efficient loan service could provide temporary funds while you continue to receive CPP-OAS benefits. A fast online loan option could serve as a short-term solution for unexpected financial needs, though it’s essential to ensure that loan repayments are manageable on a fixed income.

The Process of Applying for CPP Payments

Applying for CPP payments involves applying to Service Canada online or by mail. Applications should ideally be submitted six months before your intended start date. Service Canada will then assess your eligibility and calculate your payment based on your contributions and chosen start age.

Service Canada provides an online tool for managing CPP and other benefits, allowing you to track CPP dates, update banking information, and review your payment history. If you’re considering supplementing your CPP with a loan, ensure you are clear on your monthly budget, as online loan applications for CPP loans will typically require proof of regular income.

Adjusting Your Budget with CPP

Creating a budget around your CPP income ensures that your retirement funds last. Because CPP payments are fixed and generally only increase with inflation adjustments, they provide limited flexibility in responding to rising living costs. Tracking your expenses closely and planning for non-monthly costs will help you make the most of each CPP payment date.

If there’s a shortfall between your monthly expenses and your CPP income, a small loan or installment loan for CPP can help bridge the gap temporarily. However, assessing your ability and creating an efficient debt repayment plan to repay any borrowed funds within your fixed budget is essential to avoid financial strain.

Alternatives to Enhance Your Retirement Income

In addition to CPP and OAS, there are other ways to increase retirement income. Personal savings, investments, and other income sources like annuities or rental income can supplement government benefits. While CPP provides a reliable income, diversification can help secure a more comfortable retirement.

For instance, part-time work can add to your income and help you meet your financial goals. Alternatively, if you’re facing an urgent need, an efficient loan service from a reputable platform like GoDay can be a suitable option, as our dedicated team will take the time to understand your situation.

Seeking the best solutions for your circumstances can help you reach your financial goals and ensure financial security.

Important Considerations for Borrowing in Retirement

For some, borrowing may be a viable solution to manage unexpected costs, such as healthcare or home maintenance. Specialized CPP loans and other loan options designed for retirees can help, but it’s essential to borrow cautiously, especially with interest rates on the rise.

If you choose to get a fast online loan from a platform like GoDay, carefully review the terms and confirm that the repayments align with your CPP payment schedule. By selecting reputable lenders with favourable terms, you can ensure a sustainable balance between your loan and retirement income.

Final Thoughts on CPP and Financial Planning

The Canada Pension Plan is a significant component of retirement income for millions of Canadians, providing a consistent monthly payment that can support essential living expenses. However, understanding the nuances of CPP payment dates, eligibility, and how much you’ll receive is crucial for efficient money management.

For those in need of extra funds, options like CPP loans in Canada can provide a way to cover unforeseen expenses without straining the budget. As with any financial decision, it’s essential to consider the impact of borrowing on your fixed income. Managing your CPP payments with other income sources can help you enjoy a secure and comfortable retirement.

By taking these steps, you can make the most of your CPP and other retirement resources, creating a retirement plan that is both effective and adaptable. Whether planning your CPP contributions, preparing for the next CPP payment, or exploring supplemental income options, understanding how each component fits into your retirement strategy can bring peace of mind in your golden years.