As retirement approaches, understanding the financial resources available to you becomes crucial. The Old Age Security (OAS) pension is a key component of retirement planning for many Canadians. This government-funded program provides financial support to seniors, ensuring they have a basic income level in their later years.

At GoDay, we aim to ensure Canadians are fully aware of their funding options. This may entail applying for a loan on our platform if your Old Age Pension is insufficient or an emergency expense requires more funds than you can receive from an Old Age Pension.

Learning about Old Age Pension in Canada can help you prepare for the future. This guide will explore the essentials of the Old Age Pension in Canada. We will also touch on how financial services like GoDay can complement your financial strategy, especially if you need to manage your money and explore different types of Canadian loans.

What is an Old Age Pension?

The Old Age Security (OAS) pension is a monthly payment the Canadian government provides to seniors who meet specific criteria. The Canada Old Age Pension is funded through general tax revenues and is intended to help older Canadians cover essential living expenses, such as housing, food, and healthcare. Unlike the Canada Pension Plan (CPP), which is based on contributions during one’s working years, the OAS pension is available to all eligible Canadians regardless of their work history.

Understanding the OAS pension is crucial for effective retirement planning. It complements other retirement income sources like the CPP and personal savings, forming a foundation for financial stability during retirement.

If you don’t qualify for the Old Age Security (OAS) pension or need additional financial support during retirement, consider applying for a personal loan to cover essential expenses. GoDay offers small loans that can help bridge financial gaps. To apply, you’ll need to meet standard loan requirements, such as having a regular source of income, an active bank account, and valid identification. While the Canada Old Age Pension provides critical support, loans can offer short-term solutions when additional funds are needed for unforeseen expenses like medical costs or home repairs.

When Does Old Age Pension Start?

For most Canadians, the Old Age Pension (OAS) starts at age 65. However, there is flexibility regarding when you can collect Old Age Pension.

- Starting at Age 65: If you opt to begin your OAS pension at age 65, you will receive the standard amount based on your eligibility and residency history. It’s important to know when to apply for Old Age Pension to ensure your payments begin on time, with applications accepted up to 11 months before your 65th birthday.

- Deferring the Pension: You can choose to defer your OAS pension until as late as age 70. Doing so will give you a higher monthly payment for each month you defer. This can be a strategic choice if you anticipate needing a larger income later in retirement.

If you are unsure when to start your OAS pension or need additional financial support, understanding payday loans might help manage immediate expenses. Reputable financial institutions like GoDay offer small loans that could assist with unforeseen costs while you plan your retirement income.

Who is Eligible for Old Age Pension in Canada?

Eligibility for the Old Age Security (OAS) pension depends on several factors:

- Age: You must be 65 to qualify for the OAS pension.

- Canadian Citizenship or Legal Status: Eligibility requires Canadian citizenship or legal residency. Permanent residents and individuals with protected status may also qualify under certain conditions.

- Residency Requirements: To be eligible for the full OAS pension, you must have lived in Canada for at least 40 years after turning 18. If you’ve lived in Canada for fewer than 40 years, you may still receive a prorated pension based on how long you’ve lived there. This answers the question: how long do you have to live in Canada to get an old-age pension?

- Application: You must apply for the OAS pension to start receiving benefits. You can apply up to 11 months before turning 65 to ensure timely payments. If you don’t qualify for the full pension or need extra financial support while waiting to turn 65, small loans from reputable institutions like GoDay can help cover essential expenses during retirement.

How Much is the Old Age Pension in Canada?

The amount of the Old Age Security (OAS) pension you receive is influenced by several factors, including your residency history. You can use the Old Age Security Benefits Estimator on the Government of Canada’s website to estimate your monthly payments and plan for the future.

- Full Pension Amount: To receive the full amount, you must have lived in Canada for at least 40 years after turning 18.

- Partial Pension: The pension is prorated for those who have lived in Canada for less than 40 years. However, you may still need more access to funds during your requirement, and the good news is you can rely on online loans to fund emergency expenses, such as medical bills or sudden car repairs. Learn how to use a personal loan on GoDay’s website or contact our dedicated customer service team if you’re receiving a partial pension or need extra assistance.

- Average and Maximum Amounts: The average Old Age Pension in Canada is typically lower than the maximum amount. The maximum is reserved for individuals who meet all the eligibility criteria, including residency requirements.

Understanding how much the Old Age Pension is in Canada and planning accordingly can help budget for retirement. In addition to OAS, exploring different types of Canadian loans can provide financial flexibility as you approach retirement.

What Are the Old Age Pension Payment Dates in Canada?

OAS payments are issued monthly, typically on the third business day of each month. Payments are made on the preceding business day if old age pension dates fall on a weekend or statutory holiday. Ensuring timely receipt of OAS payments can be crucial for managing monthly expenses.

- Old Age Pension Dates: To receive your payments consistently, setting up direct deposit with Service Canada is recommended. This reduces the risk of delays and missed payments.

- Annual Increases: OAS payments are adjusted annually based on the Consumer Price Index (CPI) to keep pace with inflation. This adjustment helps maintain the purchasing power of your pension payments over time.

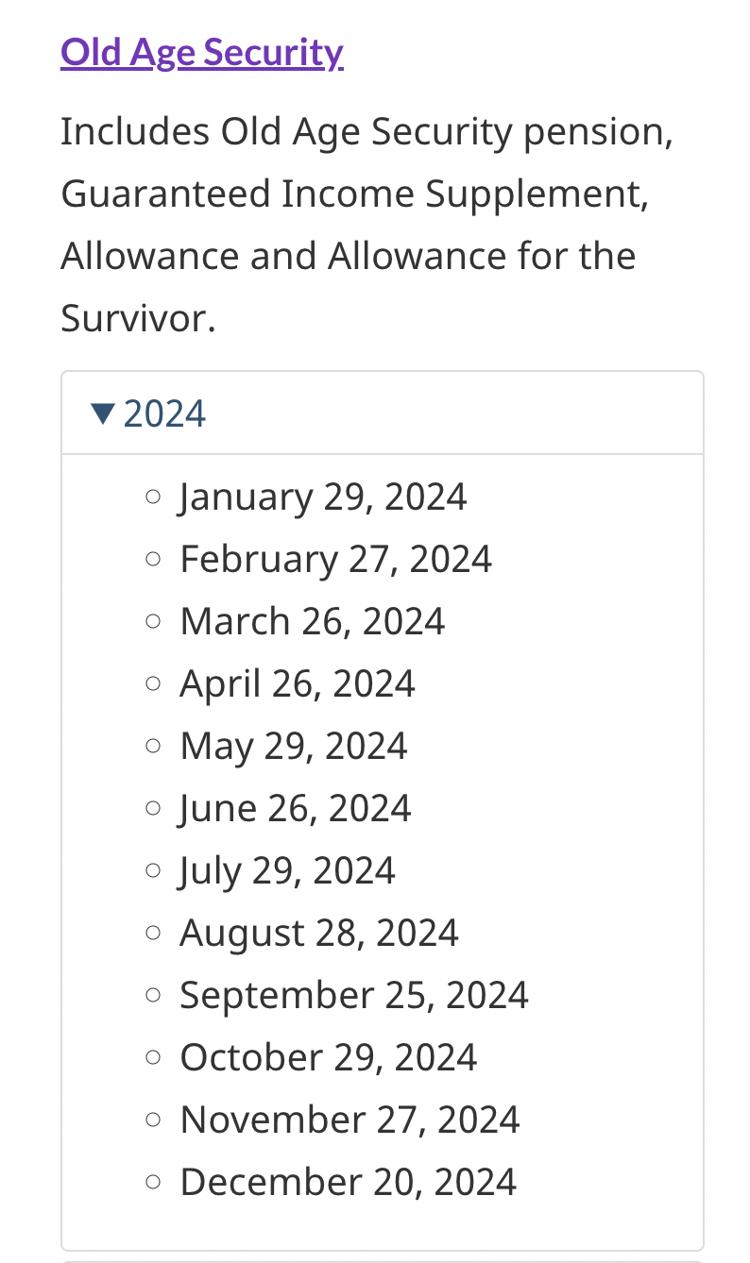

Here is the chart outlining the Old Age Security pension payment dates in Canada for 2024, retrieved from the Government of Canada website:

If you need access to cash between old age pension payment dates, a short-term loan can provide a temporary solution. Some financial institutions even allow you to take out multiple loans at once if necessary. However, being cautious and responsible when managing multiple loans is essential to avoid unnecessary financial strain. Always ensure you have a clear repayment plan and only borrow what you can comfortably manage.

How to Avoid Old Age Pension Clawbacks

High-income seniors may experience a reduction in their OAS payments due to the clawback, officially known as the OAS Recovery Tax. This reduction ensures the pension primarily benefits those with lower incomes.

Income Thresholds

The clawback begins when an individual’s net annual income exceeds approximately $85,000. OAS payments are reduced by 15% of the excess amount for income above this threshold. Even if you’re receiving the maximum Old Age Pension, exceeding this income threshold will result in reduced payments.

If you’re dealing with high medical expenses or other significant costs, planning your income carefully to avoid these clawbacks is important. Managing your income effectively will help you retain more OAS payments for essential expenses during retirement.

Income Planning

Effective income management is key to minimizing clawbacks. This may involve tax planning, investing in tax-advantaged accounts, or exploring income-splitting strategies with a spouse. By carefully managing your income, you can maximize your old age pension payments and ensure you retain more benefits for your retirement needs.

Income Splitting

By sharing certain types of income with a spouse, you can lower your taxable income and reduce the impact of the clawback.

Tax-Deferred Accounts

Contributing to tax-deferred accounts such as Registered Retirement Savings Plans (RRSPs) can lower your taxable income and help manage clawback implications.

Managing your money effectively and understanding the impact of income on OAS payments are essential for maintaining financial stability. For additional support, small loans from reputable financial institutions can provide temporary relief if needed.

Conclusion

The Old Age Security (OAS) pension is a critical element of retirement planning in Canada, offering essential financial support to seniors. You can make informed decisions about your retirement income by understanding when OAS starts, eligibility criteria, payment amounts, and how to avoid clawbacks.

If you need additional financial assistance as you plan for retirement, consider exploring how to use a personal loan or understanding payday loans from reputable lenders like GoDay. These resources can help you manage immediate expenses while you ensure a stable and secure retirement.

By staying informed and proactive, you can confidently navigate the complexities of retirement and make the most of the benefits available to you.