We know there are a lot of payday loan companies out there, particularly online. It can be a bit overwhelming, swimming through the sea of lenders (shameless “shark” reference, har har). The unfortunate truth is that there are many “companies” that are illegitimate. While we can’t protect you from those who are trying to do you harm, we can give you information to arm yourself while shopping for a short term loan lender.

When you’re ready to apply for a payday loan, the application process should be simple, straight-forward and well explained. All policies, including fees, what happens if you default, interest rates and so forth should be easily identifiable. There should be a very clear “About Us” section that includes all company contact information like mailing address, general contact emails and various phone numbers. Most importantly, if you’re applying in Ontario, Canada, you should have clear view of the payday loan business licence.

If you’re in store, this should be posted up somewhere visible. If you’re applying online, it generally would appear right before you begin your application or shortly there-after. Make sure the year range is current!

And, above all else, if you are being charged more than $21 per $100 borrowed, then do not deal with them! Ontario law stipulates that consumers cannot be charged more than this amount per $100 borrowed. However – if you default, you are subject to late fees, NSF fees and additional interest. Make sure you are aware of these fees beforehand. Click here to see a poster from the Ministry of Consumer Services.

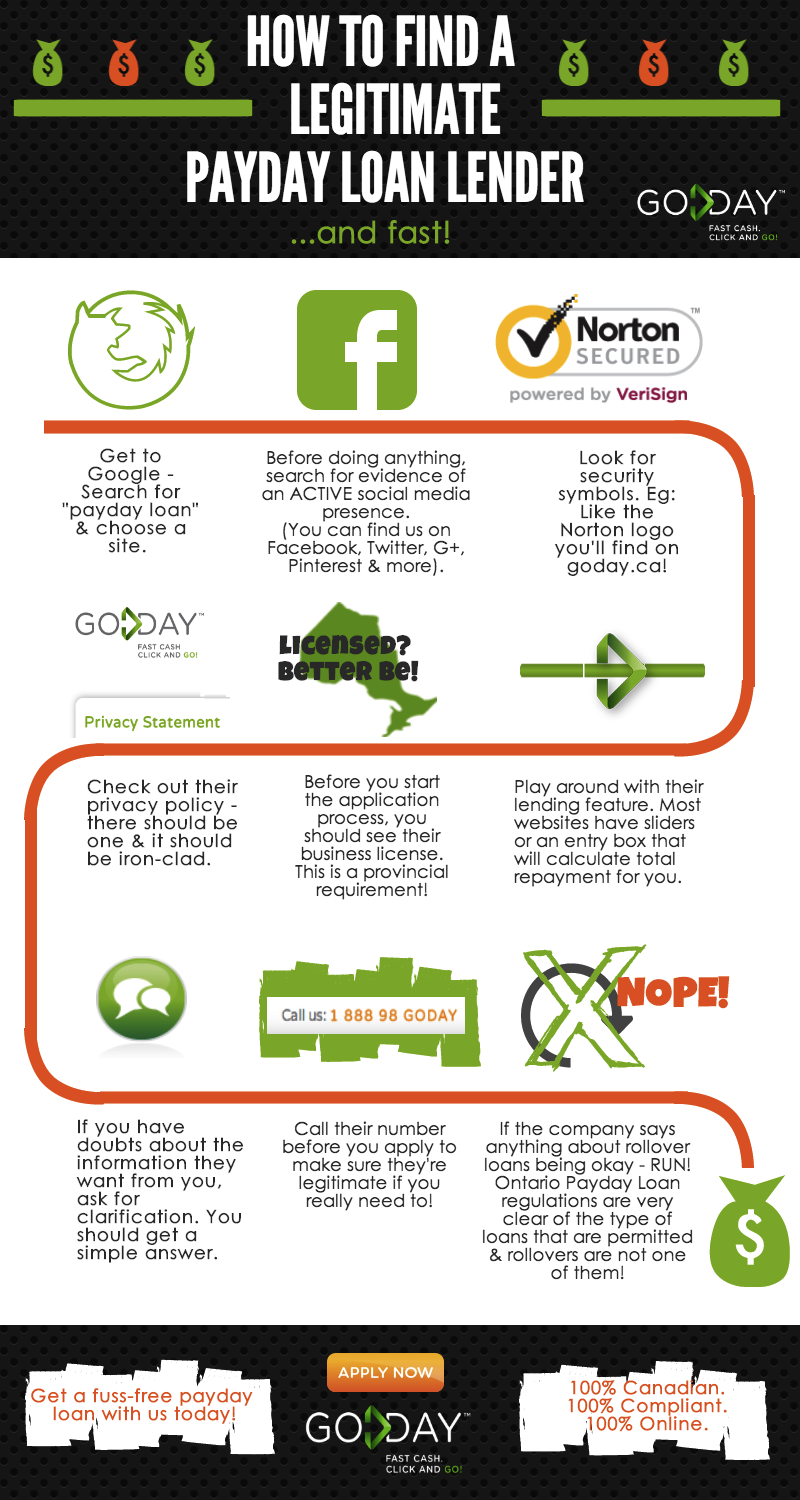

Check out our latest infographic for quick data to help you shop smart!

Like This Post? Check Out:

What Payday Loans Can Do For You

Interpreting the Ontario Payday Loan Act

Payday Loans And What You Should Know