An online payday loan eliminates in-person visits to a lender. It is so convenient it really doesn’t make sense to take time out of your busy schedule to visit an office anymore. The added bonus is that the entire process is very fast. There’s no quicker way to get cash when you need it in a hurry.

Nonetheless, you should understand how a payday loan works before you decide to borrow. Like all other financial products, it has advantages and disadvantages. Let’s take a look at when a payday loan could be your ideal solution and when you might want to consider other solutions.

How Can You Use an Online Payday Loan?

Your lender isn’t going to closely scrutinize the reasons you might want to borrow money. They usually ask that borrowers meet certain simple requirements such as continuous employment for at least three months, proof of address, and a bank account. This can make it seem like you could use a payday loan for almost anything, but you really shouldn’t.

A payday loan is a short-term financial solution and not one you should rely on for ongoing expenses. Using borrowed money to pay your bills each month will catch up with you very quickly.

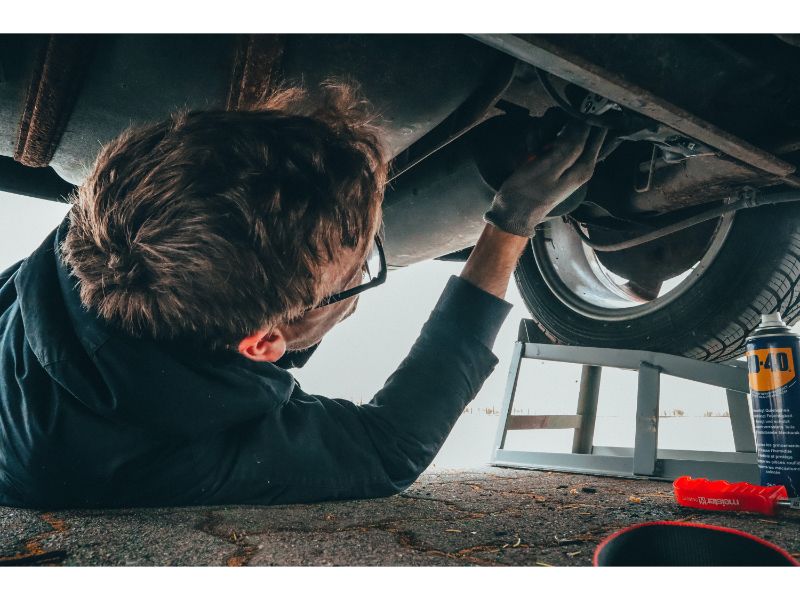

However, a payday loan can be a great option when you need to fulfill an urgent, temporary cash flow need. One example is raising money to fix your car, because you need it to get to work. Another might be depositing money into your bank account to ensure you’re not charged overdraft fees. Of course, online payday loans are ideal for emergencies such as paying for plane tickets to visit a dying relative or even providing money to pay funeral expenses.

The point is payday loans aren’t meant for taking vacations, buying the latest gadgets, or going on a shopping spree for clothes. Use them when you need to, but don’t use them for day-to-day expenses or frivolous reasons.

How Does an Online Payday Loan Work?

The maximum online payday loan amount a lender can offer in Canada is $1,500. The minimum is usually no less than $100. Many lenders only offer a smaller amount when you borrow from them the first time (typically $500). After you’ve repaid the initial loan, they may grant you credit up to the maximum amount.

Everything from start to finish is handled online. You won’t fill out a paper application form. Instead, they’ll ask you to input your information online, starting with where you live to determine which laws apply to your loan. A good lender immediately provides you with an estimate of potential loan costs so you can decide whether you want to proceed, or not.

Online lenders should only ask for basic information within their online application form. Then they will ask how much you want to borrow. Once you submit this information along with your application, the process moves very quickly. You should know within minutes whether you’re pre-approved.

At this point, the lender should also provide you with the exact cost of borrowing including the interest rate and repayment terms. These figures can vary, depending on the lender and where you live. Some provinces require payment in-full in one payment. This usually occurs on your next payday. Other provinces allow you to make multiple payments over 62 days.

Either way, it is very, very important that you have enough money in your bank account when it comes time to repay your payday loan. Payday loans may include stiff penalties and not all lenders make these fees readily apparent.

Additionally, a defaulted payday loan is reported to Canada’s two credit bureaus, Equifax and Transunion. It can take years to repair your damaged credit, and you need credit for so many things today. It’s hard to get a cellphone plan, rent a car or apartment, or even get a job if you have bad credit. Don’t borrow unless you know you can repay your loan on the specified date(s).

Can Any Lender Offer Online Payday Loans?

Almost any company can offer to lend you money online. However, you definitely want to use a lender that is licensed in your province. Otherwise, the Payday Loans Act which outlines what a lender can and cannot do won’t apply to your loan and how it must be managed.

For instance, in Ontario a licensed payday lender must post their rates and they can’t charge you more than a certain amount for every $100 you borrow. As well, a licensed lender can’t lend you more than 50% of your net income per loan to keep your debt within a reasonable limit.

Licensed lenders must clearly indicate how much you’re borrowing, the number of days involved in the loan, and exactly what you will pay to borrow. This includes any fees you will pay.

What Do You Need to Qualify for a Payday Loan?

This depends on the lender. However, most require you have a steady income, permanent address, and an active bank account.

A payday loan lender rarely runs a credit check and if they do it usually doesn’t impact your credit file. However, it is important that you check the website before you decide to apply.

If the lender uses a hard inquiry, it will show up on your credit report even if you decide not to borrow from them. If you do this several times, it can have a negative effect as it may appear you’re having difficulty obtaining credit.

How Long Will You Have to Wait?

Once again, this depends on the lender. Good ones will let you know within minutes whether you’re pre-approved. If so, you can review the terms offered and decide if you want to move forward. As mentioned, this usually doesn’t impact your credit file when you choose a reputable lender.

Can Payday Loan Terms Vary?

Absolutely. Regulated lenders must adhere to the Payday Loans Act which limits what lenders can do. However, unregulated lenders may charge phenomenally high interest rates and even higher penalties should you default on your loan.

Unlicensed lenders may also lend you unreasonable amounts that can add financial pressure to your life, instead of fulfilling a short-term financial need. They can also be abusive, intrusive, unethical, and unreasonable, without recourse as they aren’t governed by protective legislation.

Read the terms carefully before you decide to borrow. You are under no obligation until you sign your loan documents. Even then, most provinces provide a 2-day cancellation period should you decide you don’t want to borrow.

What Happens If You Want to Move Forward?

The lender then prepares your loan documents for signature. Licensed payday loan lenders must clearly indicate repayment terms including payment dates, the total amount of the loan, and penalties. Once you sign your documents electronically, your agreement comes into effect.

How Long Until Funds Release?

This depends on the lender. Check the lender’s website for their definition of “fast” or “quick”. A good lender should provide money in your bank account or an email money transfer within 24 hours, at the latest.

How Is Your Online Payday Loan Repaid?

It is all handled automatically. Your lender withdraws your payment from your bank account on the agreed repayment date for the exact amount owing. All you need to do is make sure that you leave enough money in your account on payday for your payment.

Do They Offer Fantastic Customer Service?

Customer service really sets good lenders apart from the bad or mediocre. If the lender only offers support through email, you might want to look elsewhere.

At the very least a payday loan lender should offer a toll-free number you can use during their business hours. If they offer multiple contact options, even better. Look at their website too. Do they have a FAQ section that covers common concerns?

The GoDay Payday Loan Advantage

Online lenders aren’t created equal. Some have exacting standards while others are more lenient. Some are fly-by-night companies that aren’t provincially regulated, while others follow the letter of the law.

Here are a few reasons why you should consider GoDay for your online payday loan.

Simple Requirements

GoDay believes in total transparency. Here are our simple requirements for an online payday loan:

- Canadian resident over the age of 18

- Permanent address

- Active account with a Canadian bank or credit union

- Steady source of income through direct deposit

- Active, valid personal email account

- Active, valid home or cellphone number

We’re Licensed

GoDay is a licensed payday loan lender in BC, AB, SK, MB, ON, NB, NS, and PEI. We’ve provided payday loans to Canadians since 2012.

We’re Reputable

GoDay is a Canadian financial leader and a member of the Canadian Consumer Finance Association. We also comply with all provincial loan regulations.

We’re also a proud member of the Better Business Bureau and have over 1,200 TrustPilot reviews, with an overall ranking of “Excellent”.

We Protect Your Data

GoDay cares for your personal and financial data. We use industry standards and best practices to safeguard your information. We do not share your data with third-parties.

If you have questions or concerns regarding your rights, obligations, or privacy our customer service representatives are here to help. You can also read more if you’re concerned about online data security here.

We’re Fast

Our application process and decision on your loan only takes a few minutes. If you need money in a hurry, you’ll be hard-pressed to find another company that can get money to you faster.

We’re Canadian

Yes, that’s right! We live and work in Canada and always have. We have our headquarters in Toronto and offices in Vancouver, Calgary, Regina, Fredericton, and Dartmouth, even though we are a 100% online lender.

Get Started

Whether you are ready to start the application process or want more information, please visit our website. Let us show you why so many Canadians choose GoDay over other payday lenders.